BUSINESS SERVICES

Learn more about our various business services

BENEFITS PLANNING

As a Certified Retirement Counselor, a CRC® and a Certified Plan Fiduciary Advisor CPFA®, we have additional training to help your business prepare you and your employees for retirement. We work with your payroll and accountants to get the plans implemented, with referral for Third Party Administrators (TPA). Record Keepers, and ERISA Lawyers (if necessary).

We are dedicated to developing lasting relationships with all our clients and plan participants. We believe education is the key in helping you and your plan participants to determine financial goals and planning for their future retirement needs.

Here are a few questions you may ask to determine which retirement plan works best for your business AND you?

- Do you have employees?

If not, do you plan on hiring? - Do you have high employee turnover?

- What is the best way to max out your contributions and minimize taxes over time?

- Do you want to allow your employees to contribute or do you want to contribute for them?

- Which plan is best for your situation a Solo 401K, a 401K, a Simple IRA, a Sep IRA?

Do you qualify for a 403B? - What are Profit Sharing Plans, ESOP, Cash Purchase Plans?

The benefits of working with us is our ability to provide:

• Clear, easily understood explanations of investing options

• Participant financial planning

• Participant financial workshops both online and in person

We specialize in:

- 401k Planning

- Enrollment Support

- 3(21) / 3(38) Fiduciary Support

(Through Third Party Fiduciaries)

- Employee Financial Education

- Risk Management

- Employee Retirement Counseling

YOUR FIDUCIARY LIABILITY

Are You Prepared for a DOL Audit?

There is no question that considerable responsibility is placed on plan sponsors & fiduciaries for plan investments. In fact, ERISA Section 409(a) imposes personal responsibility on fiduciaries who breach their duties.

1. Do you have an Investment Policy Statement on your plan that is written properly and executed annually?

2. Do you have a 3(38) solution on your plan which may reduce your fiduciary liability?

3. When was the last time you had your plan benchmarked?

Do You Have Fiduciary Responsibility and Liability for Your Company's Retirement Plan?

ERISA defines “fiduciary” to include persons who have discretionary authority or control over the management or administration of a deferred compensation plan, or anyone who exercises authority or control over the plan’s assets. Examples include the plan sponsor, plan investment committee members and plan trustees. Among their responsibilities, fiduciaries must act solely in the interest of plan participants and beneficiaries, and meet high standards of care, skill and prudence. Fiduciaries can be personally liable for losses if they fail to live up to ERISA’s fiduciary standards.

NOTE: In the ENRON settlement, outside members of the board and the chair of the plan committee contributed to a settlement from their personal assets.

Our Open Architecture offering provides you with a solution:

- Transfer of fiduciary responsibility to an ERISA 3(38) investment manager

- Investment options untilizing ETFs, which are typically lower cost than mutual funds

- Development of fund lineup (ETFs and mutual funds)

- Ongoing fund monitoring and replacement when appropriate

- Ability to choose your plan's Third Party Administrator (TPA)

ADVANCED BUSINESS PLANNING

Have you thought of some of the financial business risks you may face?

Business Liability & Taxation risks:

How is your business structured and would it be better to be a:

- Sole Proprietor

- S-Corp

- C-Corp

- LLC only or combined with one of the above

- We work with your Accountants, Lawyers and Business Property & Casualty Professionals to help you with these decisions.

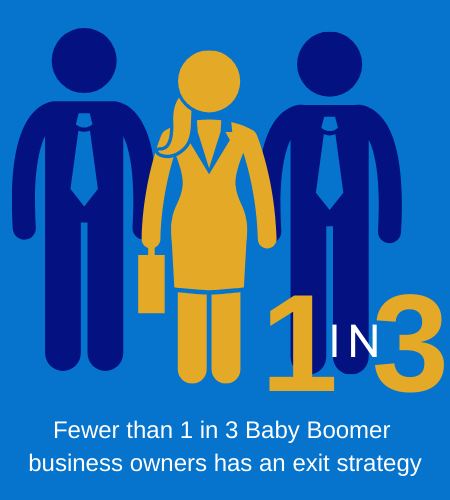

Succession planning risks:

- Do you have a partner?

- If something happens to either of you, do you have a Buy-Sell Agreement? Or do you want to be in business with your partner's wife or possibly one of their kids?

- Do you have a way to fund the Buy-Sell Agreement or are you relying on your partner to have saved the funds?

- Do you have disability insurance for yourself and your partner?

- Do you have Key-Man Insurance to help for temporary replacement of your partner or yourself? This could protect you from having to sell the business or find a new partner.

(Each partner plays a different role in the business. You may not be the one who brings in the business and your partner may not know the day to day workings or vice versa. Make sure you can hire someone until things are worked out without having to strain the profits!) - Do you know how much your business is worth?

Other risks:

- How could a Partner's Divorce affect your business?

- Could you or your partner afford to buy an Ex out of the business?

We know these questions can be overwhelming, but you are not alone. We are here to help you through the process.

To Best Serve Our Clients, We Are Limiting

The Number of New Clients Each Month

Get Started TODAY To Ensure Availability!

For your convenience we offer appointment online scheduling 24 hours a day.

|

|

|